Market Highlights

1 - Elon Musk says the Trump tariffs will cause a recession in the 2nd half of 2025

2 - Xi: China and US agree to start a new round of trade talks

3 - ECB cuts rates by 25bps in June as expected

4 - US 10yr yields up 3.4bps; WTI crude up $0.52 to $63.37; Gold down $19 to $3356

5 - Goldman Sachs on NFP: expect $125K new jobs, unemployment remain at 4.2%

Daily Price Activity

Insights

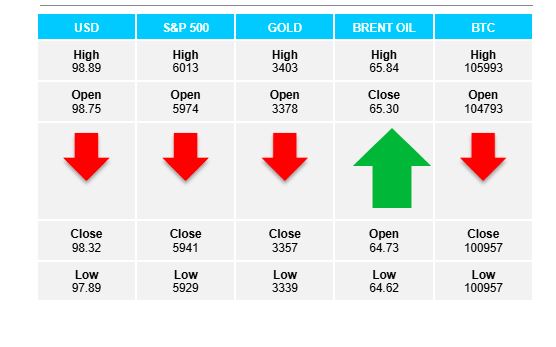

USD INDEX Sellers took control from the open and went on to set support at 97.90 before the US session got started. Buyers did step in and recouped a portion of the losses to at close 88.27. Resistance sits at 98.89. The bias and trend remain down as negative sentiment continues to surround the USD. Buyers will watch for positive job numbers tomorrow as a potential catalyst to spur a USD fightback.

S&P 500 Buyers broke above resistance, briefly, before sellers took over and did enough to set a lower low and produce the first red candlestick of the week. Resistance was set at 6018 with support established at 5920. The gentle move lower was enough to initiate the EMAs to cross downwards. Buyers will aim to retest above 6000 while sellers look below 5900 in an attempt to add to the new downtrend. Note that the USD and US equity markets both moved lower today.

GOLD The sideways activity continued with green and red candles alternating for the past 6 days. Resistance sits at $3403 with support established at $3337. Notwithstanding the red candlestick, the bias and trend remain up. With uncertainty on so many fronts - the global economy, geopolitical conflicts and market nervousness - the metal’s safe haven status could see buyers step in and look up to retest current resistance levels. Noteworthy that the USD, S&P and gold all moved in the same direction, lower on the day.

BRENT OIL Brent continued to move sideways within a narrow $1 range, with buyers winning out and a green daily candlestick confirming resistance at $65.64 with support at $64.62. The trend remains up with the bias tilted to the upside. On the upside buyers will look above $65 and aim to test the $66 mark, while sellers look below $65 to test the $64 level.

BITCOIN Finally the break did come…to the downside as sellers took control and went on to set support at $100.7K with the $100K level clearly in sight. Resistance sits above at $106.1K. Buyers looking for a reversal will watch for a bounce up on the shorter time-frames, while sellers may see retracements as new selling opportunities. Traders will be well served to exercise patience regardless of choosing a direction.

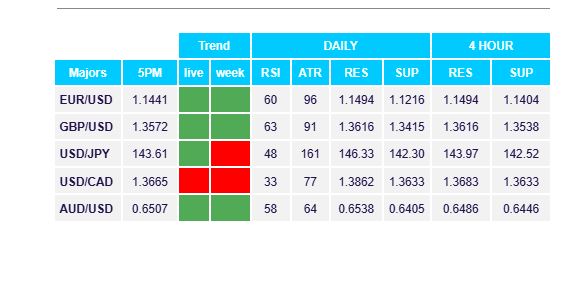

FX Pivot Levels