Market Highlights

1 - Trumps big boosted steel tariffs will take effect 12.01am on June 4

2 - Gold down $27 to $3351; WTI crude up $0.90 to $63.43; USD leads, JPY lags; USDJPY up a full cent as US economy keeps on rolling

3 - JOLTS April jobs openings $7.39m v $7.10m expected

4 - White House confirms it wants best trade deal offers by Wednesday

5 - BOA: This weeks ECB meeting likely a non-event. Widely anticipated 25bps rate cut

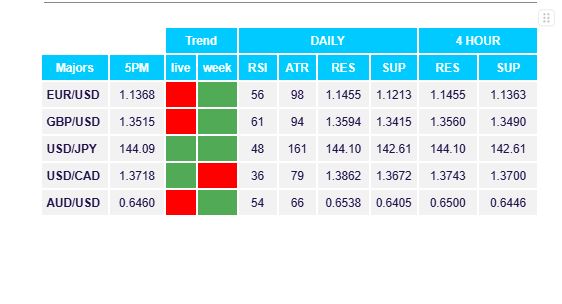

Daily Price Activity

Insights

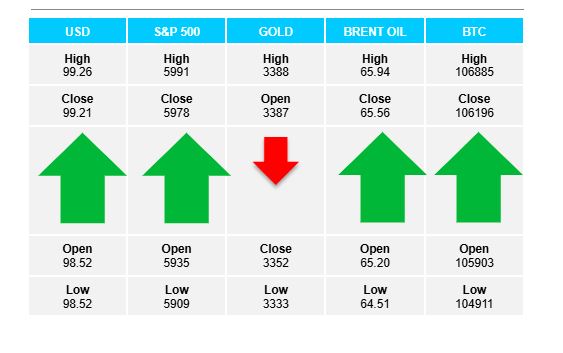

USD INDEX A complete daily reversal saw buyers open at yesterdays low and close at yesterdays high. Support sits at 98.52 with resistance established at 99.28. While todays rally wiped out the losses from yesterday, the downtrend remains intact. Positive economic data continues to add credence to the U$, in spite of the negative sentiment surrounding the USD.

S&P 500 The demand is gentle as buyers add a 3rd consecutive day of higher highs and higher lows on the chart. Resistance at 5992 matches the highs from last month - May 19/20. Support sits at 5907. Traders seem to be willing the markets higher on the premise that no news is good news.

GOLD Following a slight gap up and push higher, sellers stepped in and retraced a portion of yesterdays gains on the way to setting support at $3335. Resistance sits at $3391. Note that notwithstanding the red candlestick and move lower, todays candlestick reflects a higher high and higher low on the charts with the uptrend firmly intact. While buyers aim above $3400 sellers look down at the $3300 level in order to signal a reversal rater than a natural retracement.

BRENT OIL Buyers had another strong day adding to yesterdays gains and a 3rd successive day of higher highs and higher lows on the daily chart. Support sits at $64.48 with resistance at $65.94, matching the highs from last month (May). Buyers will look higher aiming at $67 while sellers look below the $65 mark to halt the uptrend and positive bias.

BITCOIN For the 2nd consecutive day buyers and sellers made brief moves with no follow through as price action remained constrained within a narrow $2K range between $104.8 on the downside and $106.8 on the upside. The doji-like candlestick confirms the lack of direction with the past 3 daily close prices at $105.7K, $105.9K and $105.9K respectively. While the trend remains down, note the higher highs and lows reflected over the past 4 days.

FX Pivot Levels