Market Highlights

1 - USD declines as traders fear US/China trade issues; USDCAD trades to new 2025 low

2 - Major US indices close higher to start the week. Some of the big gainers: META, SOFI; big losers: TSLA, GOOGL

3 - WTI crude up $1.73 to settle at $62.52; Gold up $80 to close $3380; US yields closed higher on the day

4 - European indices close mixed. DAX, CAC down, FTSE, Ibex up

5 - EU says it will make strong case for US tariff cuts this week

Daily Price Activity

Insights

USD INDEX Sellers were in control from the open and did not let up as the USD was battered against all the majors with the index confirming the sharp sell-off. Resistance sits at 99.28 with support established at 98.52 showing little indication of a retracement at the close. Rather than any one particular factor, it seems the move lower is an accumulation of negative US sentiment which is reflected in the global reserve currency being questioned. Although buyers have stepped in periodically, even strong economic data has been unable to reverse the year-long downtrend.

S&P 500 While the sideways trend continues, the bias remains up as the equity index made slight gains with overall demand enough to produce a green daily candlestick. Support sits at 5865 with resistance at 5944, testing the upper limits of the recent range. Although the market is nervous, it appears that the lack of new tariff news is enough to keep buyers on the front foot. The move higher is a natural correlation with the strong USD downturn.

GOLD A strong day for the metal as buyers wiped out last weeks retracement confirming demand for the safe haven commodity. Following a slight gap down at the open and a brief push lower, buyers stepped in at the $3000 support and went onto gain $80 and establish resistance at $3380. The uneasiness surrounding the financial markets, precarious geopolitical conflicts and golds traditional inverse relationship with a weak USD, all contributed to the sharp move higher. While buyers eye the $3500 record highs, sellers look down at the pivotal $3000 level.

BRENT OIL A gap up to start the day was followed up with buyers not giving up control and bouncing back from intermittent pull backs during the session. Support sits at $63.81 with resistance established at $65.71. Significantly todays high cancelled out the preceding series of lower highs. Buyers will look up to test the $67 mark, while sellers aim below $64 to reverse the new uptrend.

BITCOIN Neither buyers or sellers were able to capitalize on intraday moves as price action remained within a relatively narrow range between $103.6K and $106K. The activity continues sideways within a broader downtrend. Based on past behaviour this year, breakouts from a sideways trend tend to favour an upside move. Buyers will aim above $106K at a minimum while sellers aim to retest below $104K.

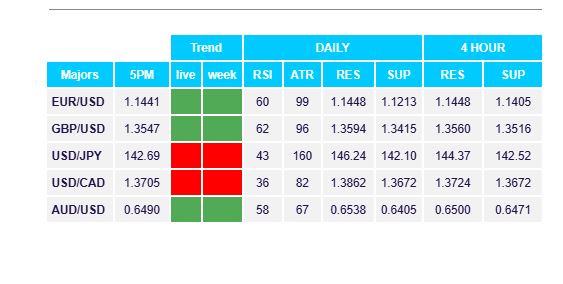

FX Pivot Levels