Market Highlights

1 - Major US stock indices close lower on the day. DJ -0.58%, S&P -0.56%, NASDAQ -0.51%

2 - Crude oil rose $0.92 at $61.82; Gold fell $6.59 at $3294

3 - Major European indices close the day lower; German DAX backs off record high level

4 - RBNZ cuts by 25bps; MUFG looking for yen strength, say BOJ likely to remain unmoved

5 - “NVIDIA business is still booming, even with the company effectively shut out of China”

Daily Price Activity

Insights

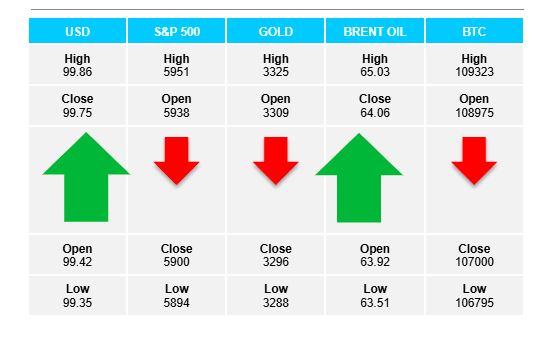

USD INDEX The U$ had a strong day after a slight gap down to start, going onto establish a higher high and higher low on the daily chart. Support rests at 99.35 with resistance set at 99.86. Todays push left the index close to testing the 100.00 mark with the EMAs crossed upward on the 4 hour and hourly charts. It appears the USD continues to feel the momentum from yesterdays upbeat consumer confidence report.

S&P 500 In traditional textbook fashion the inverse relationship between the USDX and S&P index played out with a sharp push down and sellers dominating the session. Resistance sits at 5952 with support established at 5892. The downtrend remains intact with a red candlestick on the charts. Note that despite the move lower, price action resulted in todays candle reflecting a higher high and higher low on the chart. Buyers will look up at 6000 to extend the uptrend while sellers aim to maintain below 5900.

GOLD Again the inverse relationship between the USD and gold played out with a strong U$ clearly contrasted with the 3rd consecutive red candlestick on the daily chart. Resistance sits at $3325 with support at $3287. Note the support area has held strong for 5 of the past 6 trading days with the $3300 level continuing to look pivotal. The fundamentals remain the same for the safe-haven commodity as buyers remain on the sidelines waiting for a reprieve from the recent upbeat USD bias. Geopolitical conflicts in Ukraine and the Middle East, and the apparent stand-off between Trump and Putin could well get out of hand and create renewed interest from buyers.

BRENT OIL A mixed day for oil ended with buyers winning out and a green candlestick confirming the move higher. After establishing support at $63.48 buyers stepped in and went on to drive the price up to $65.01 resistance. In so doing the price broke above the descending trendline before the sharp reversal back down to again close below the trendline and add to the sideways trend which has contained buyers and sellers for the past 10 days.

BITCOIN Sellers were in control throughout the day with lack of demand on the buyers’ part. The $109.3K resistance was unchallenged with support established at $106.7K. Notwithstanding the push lower, price action remained contained, with the support area holding out for the past week. While buyers look up at the $109K - $110K area, sellers will look below $106K, or at a minimum keep prices below the descending trendline from the record high $112K area.

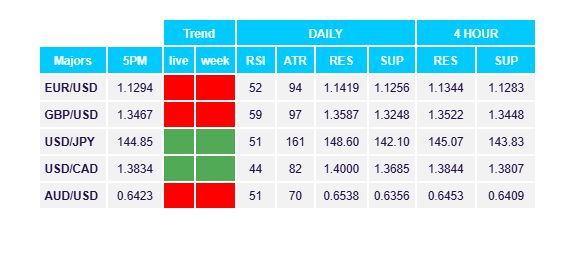

FX Pivot Levels