Market Highlights

1 - Stock close mixed with S&P and DJ little changed. NASDAQ higher with TSLA, GOOGL, NVDA and AMZN all up on the day.

2 - Reserve bank of New Zealand expected to cut rates on May 28 - unanimous view.

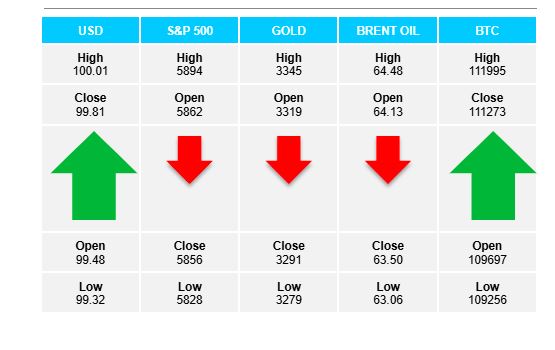

3 - Yields reverse lower, 10 yr down 6bps; Bitcoin hits new record high near $112K.

4 - Gold down $32 to $3292; WTI crude down $0.47 to $61.09

5 - Goldman Sachs: 2 key reasons for USD weakness through 2025 - trade policy and global asset diversification

Daily Price Activity

Insights

USD INDEX Buyers did enough to halt the slide with a brief bounce up and recouping yesterdays losses. Support sits at 99.32 with resistance established at 100.03. The trend remains down with negative sentiment continuing to hang over the USD. RSI is at 45. Buyers may look at yesterdays low as a higher low on the dailies with an eye on maintaining above the 100.00 mark. Sellers will aim to break below 99.00.

S&P 500 A relatively slow day as neither buyers or sellers took control, with sellers managing a slight win on the downside. The doji-like candlestick confirms the indecision. The trend remains down and todays candle does confirm a lower high and lower low on the charts. RSI is at 56. Resistance sits at 5893 with support set at 5824. Note the support matches the resistance from March 24th.

GOLD A brief rally and a higher high was short lived as sellers did step in and briefly halted the uptrend. Resistance established at $3296 with support sitting at $3280. The move lower coincides with the gentle USDX move higher - the traditional negative correlation between the two instruments. The move lower seems a natural retracement rather than a reversal as the commodity retains its safe haven status. Sellers could interpret todays high as a lower high on the daily chart. Buyers look above $3300 as a first goal in resuming the uptrend.

BRENT OIL Sellers added to yesterdays sell-off and pushed lower on the way to establishing support at $63.04 with resistance above at $64.47. The downtrend which started May 14th has been controlled by sellers with buyers standing on the sidelines and demand taking a backseat.

BITCOIN Buyers picked up from yesterday with a new resistance and new record high measured at $111.8K. Support sits at $109.2K. Technicals and fundamentals all line up, with positive crypto sentiment contributing to the move. Note that as price action continues to trade in unchartered territory, the moves up could be sharp with no previous resistance or support levels for reference. Contributing factors to be taken into account - profit taking and overbought signals, RSI reads 77.

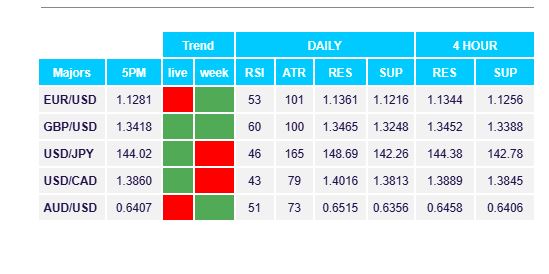

FX Pivot Levels