Market Highlights

1 - AUD: CBA brings forward rate cut forecasts, flags risks of earlier and deeper easing

2 - Canada rate cuts hope dwindle after hotter core CPI

3 - WTI crude down 7 cents to $62.56; US 10yr yields up 1 bps; Gold up $65 to $3293

4 - European equity close: strong gains as Spain hits another record

5 - Deutsche Bank: sell the USD; re-emergence of the Yen to provide the counter-punch

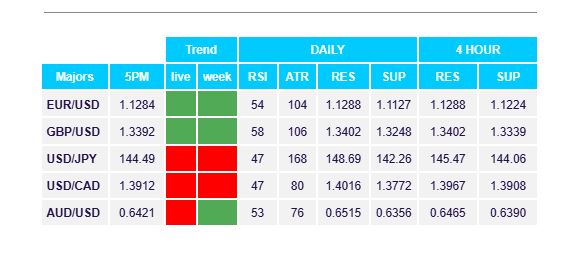

Daily Price Activity

Insights

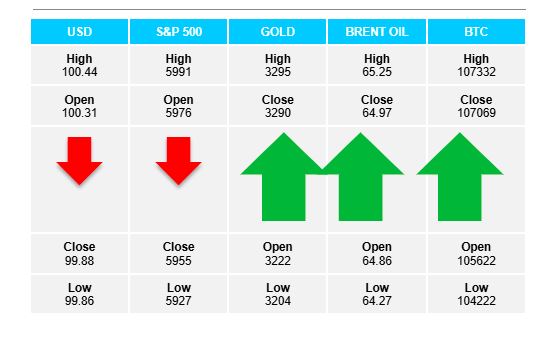

USD INDEX Sellers did not let up through the day with a strong push lower adding to the downtrend resulting in the charts confirming a lower high and lower low for the 3rd consecutive day. Resistance sits at 100.46 with support established at 99.82. Rather than any specific data or event contributing to the sell-off, it feels that the weight of negative sentiment surrounding the USD has added to the move lower. Without a positive reason, the default move is down.

S&P 500 Today saw limited moves in the equity markets with sellers winning out, but very slightly. The trend and bias remain up with a higher low on the red daily candlestick. Resistance sits at 5990 with support at 5923. Buyers will look to test the 6000 level as the next upside target, while sellers will aim below 5900 in any attempt to reverse the trend. Since the current uptrend which kicked off April 22nd, any breathers and levelling off have been met with buyers maintaining demand and gently adding to the positive mood surrounding the equity markets. Now that the tariff news appears to be somewhat settled, the stock markets have responded positively.

GOLD A strong day for the metal with buyers stepping in at the $3201 support and pushing higher throughout the day on the way to establishing resistance at $3295. Todays move was enough to cross the EMAs upwards and restart an uptrend. Buyers will aim above $3300 with sellers looking down at the solid $3200 floor. Note the traditional inverse relationship between gold and the USD.

BRENT OIL In limited activity neither buyers or sellers held on to any intraday moves with price action contained within a narrow $1.00 range between $64.24 and $65.26. The sideways trend moved into its 4th consecutive day with a doji-like candlestick confirming the lack of direction.

BITCOIN The early push lower saw support set at $104K, which was followed by buyers going on to erase the losses and matching yesterdays high with resistance established at $107.2K. For the past 2 days sellers have run out of steam when buyers step in and the bias and mood remain positive for the cryptocurrency. The record high of $109K appears to be the next upside target.

FX Pivot Levels