Market Highlights

1 - US stocks close marginally higher; S&P up for 6th consecutive day; European major indices close mixed on the day

2 - Reserve Bank of Australia 25 bps rate cut expected

3 - At the open the USD was sharply lower, by end of day most had recovered modestly against major counterparts

4 - Fed is uncertain; Moody downgrade fear subsides; Crude settles at $62.69 up $0.20

5 - US Treasury does not expect any new trade deals at G7 meeting this week

Daily Price Activity

Insights

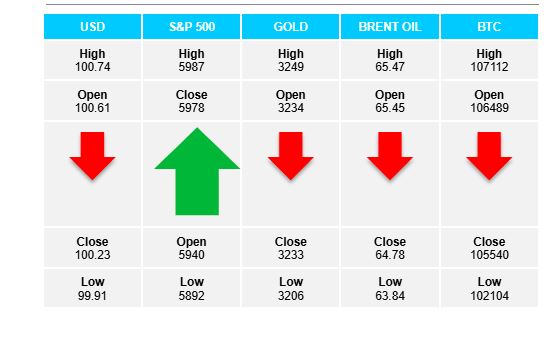

USD INDEX The USD sold off early and although buyers attempted to reverse the losses, the index did not recover fully as sellers went on to win the day. The push lower was enough to cross the EMAs downward and signal a new downtrend showing a lower high and lower low on the chart. Resistance sits at 100.74 with support established at 99.90. Moodys downgrade added to the negative sentiment surrounding the U$.

S&P 500 An early move lower in pre-market hours did not stop buyers from confirming demand and adding to the gentle uptrend, going on to close above the open and setting resistance at 5990. Support sits at 5886. The equity green candlestick is in contrast to the red USDX candlestick - traditional inverse relationship between the 2 indices. Buyers continue to look higher at the 6000 level. Sellers aim below 5900.

GOLD A quiet day with neither buyers nor sellers making a move outside a narrow trading range between $3206 and $3252…before settling in its now familiar $3230 comfort area. The trend remains down with the bias flat as the metal continues to wait for a new influence… sellers adding to profit taking, an inverse relationship with a USD rally, or alternatively, buyers reacting to unsettled geopolitical conflicts, responding to a USD sell-off - either way a new spark to ignite a new trend. Note buyers have not been able to string 2 consecutive up days.

BRENT OIL Oil continued to trade in a sideways range between $63.84 and $65.48 for the 3rd consecutive day. The uncertainty in the market continues to be reflected in price action reacting to the different factors: global supply concerns, global geopolitical conflicts, global economic slowdown, trade deals not settled….all contributing to the lack of direction. Bigger picture - buyers look above $66 while sellers look below $63.

BITCOIN Both buyers and sellers took turns in flexing their muscle with sellers winning out on the day. Todays range saw support established at $102K with resistance set at $107.2K. Trend and bias are up. RSI has maintained above 60 since April 21st. Buyers have their eye on the $109K high while sellers look down below $104K.

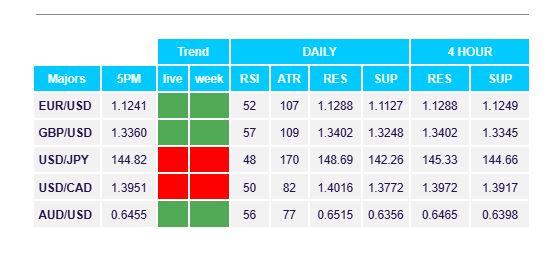

FX Pivot Levels