Market Highlights

1 - Citi forecasts: gold stabilize between $3000 and $3300, July Fed cut instead of June

2 - Gold down $90 to $3233; WTI up $0.94 to $61.96; US 10 yr yields up 4.47%

3 - Major European indices close higher on the day

4 - Goldman Sachs expects Fed rate cut in December and not July

5 - US stocks close sharply higher on China trade news. DJ +2.8%, S&P +3.2%, NASDAQ + 4.3%

Daily Price Activity

Insights

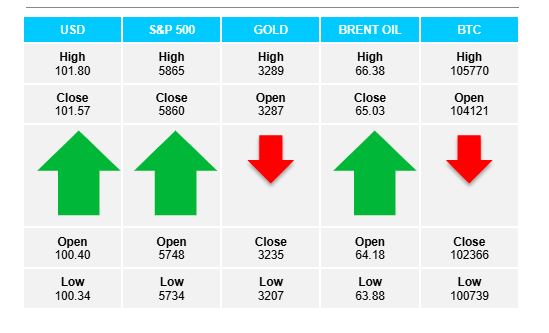

USD INDEX The U$ set the pace for an all-round risk-off day following a positive trade meeting between US and China. Demand maintained throughout the day from 100.38 support with buyers establishing resistance at 101.82. The fundamentals and technicals both contributed to the year long negative US sentiment taking a pause and adding to last weeks uptrend. Buyers will eye 102 while sellers aim below 101 as a first goal in reversing the uptrend and returning to the big picture of USD weakness - note the current level 101.60 - 101.80 testing the descending trendline.

S&P 500 The positive trade meeting between US and China saw the major US equity markets rally from pre-market right through to the close. The S&P confirmed the mood with demand not letting up from 5740 support up to the 5860 daily resistance. Trade deals and certainty will keep buyers looking to add to the trend with the 6000 level now in view. It appears that sellers may remain on the sidelines as long as there are no new surprises to derail the newly found positive sentiment. Yes the news is positive, yet my question is… the situation was created by the White House and has the US come out of this trade war better off than before they started it?

GOLD Following the positive trade deal between US and China, the risk on sentiment took its toll on gold as sellers went on to establish support at $3207, matching the low from May 1st. Sellers will aim below $3200 with $3166 (high from April 3) being the next downside target. It is noteworthy that following each pull back and retracement since the start of the year, buyers have stepped in at every level confirming demand for the safe haven commodity. Aside from trade related issues, the metal will also react to global geopolitical unrest which continue to remain unsettled - Ukraine/Russia and Middle East conflicts.

BRENT OIL The early rally wasn’t maintained with sellers ending the day on the front foot, closing at $$64.98. Support sits at $63.94 with resistance set at $66.34. Oil has many conflicting factors with the daily trend pointing upward, while the hourly has crossed down and the 4hr close to crossing lower at the end of the day. Possible supply concerns and no visible progress in unsettled global geopolitical conflicts remain factors which may affect the market.

BITCOIN A volatile wide trading range between $105.9 resistance and $100.5 support ended with sellers winning out on the day. While todays move tilts the bias downward, the trend remains up. Buyers will aim to retest $106K while sellers look below the pivotal $100K level. Note the resistance area has been tested for the 3rd time since December 2024.

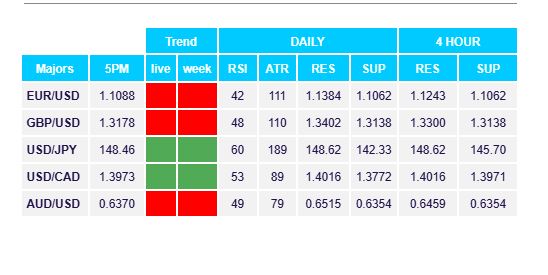

FX Pivot Levels