Market Highlights

1 - Major indices closed higher for the first time this week. DJ +0.70%, S&P +0.43%, NASDAQ +0.27$

2 - Fed Chair Powell: I don’t think we can say which way this will shake out. USD rallies throughout conference

3 - USD moves higher against all major pairs; 2, 5, 10 and 30 yr yields all move lower

4 - Crude oil -$1.15 to $57.93; Gold -$68.50; Fed left rates unchanged

5 - European major indices close lower on the day

Daily Price Activity

Insights

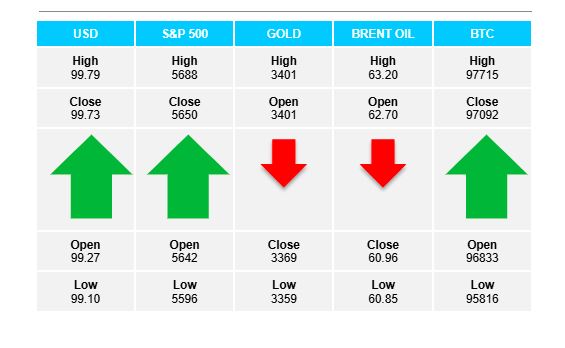

USD INDEX Following 3 down days, the USDX rallied through the afternoon portion of the US session to close at 99.73. The move higher kept the uptrend intact, although price action continues to trade within a broader sideways 100 pt range between 99.00 and 100. Note todays high adds to the succession of lower highs on the daily chart.

S&P 500 The brief 2 day retracement was held up today as buyers were able to close marginally higher than the open and ensuring a green candlestick. Buyers and sellers traded blows earlier with neither side making a significant move and basically ending the day where it started - hence the doji-like candlestick. Resistance sits at 5688 with support at 5595. Buyers continue to aim above 5700 while sellers look below 5600.

GOLD The metal gapped down significantly to start the day - from yesterdays close at $3434, to opening at $3400. The late USD rally contributed to a further push lower as gold went on to close at $3360 support. The mood and sentiment surrounding the safe haven commodity has not changed with potential buyers waiting to step in, as per previous short term pull backs. The trend remains up with the bias continuing to tilt to the upside. That’s technical, fundamental and sentiment factors all weighed up on the demand rather than supply side. Downside considerations: profit taking and technical overbought signals.

BRENT OIL Buyers put in a brief early bid to establish resistance at $63.29. The move higher was short lived as sellers stepped in to erase the gain and push lower to establish support at $60.81, before going on to close at $61.00. While buyers will look up to retest the $63 level, sellers may see todays high as a lower high on the daily chart.

BITCOIN A day of limited activity with buyers edging out a slight win to close higher. Sellers tested lower and established support at $95.7K, before buyers took over and went on to set resistance at $97.7K - a narrow $2K daily range. While the uptrend remains in place buyers look to continue to test and break above $98K on the upside while sellers continue to aim below $95K. The trend remains up with the bias also tilted to the upside.

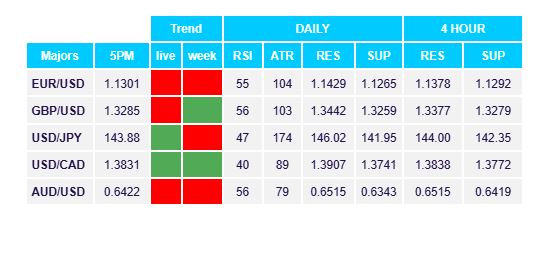

FX Pivot Levels