Market Highlights

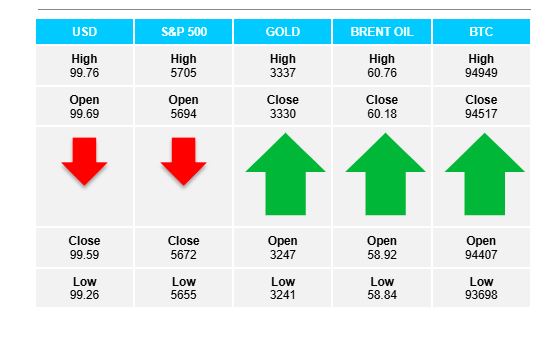

1 - Major US indices close lower; S&P and NASDAQ never get out of negative territory

2 - Gold up $92 to $3332, Bitcoin little changed at $94276, US Debt market: yields are higher across the board, crude down $1.16 to close $57.13

3 - US rejects Japan’s request for full exemption from reciprocal tariffs

4 - USDCAD in focus: Trump says he bets Carney wants to make a deal in Tuesdays visit

5 - Morgan Stanley: FOMC on Wednesday - no change, BOE on Thursday - 0.25 bps cut

Daily Price Activity

Insights

USD INDEX The U$ started the week with sellers in control and 99.23 support established early in the European session. As has become a familiar pattern we saw a turnaround when the US session got underway as buyers recouped most of the losses to end the day back where it started with resistance set at 99.61. The narrow trading range and doji-like candlestick did little to change the big picture where the trend and bias remain up. Buyers will aim above 100 while sellers look to retest the low 99.20 support area.

S&P 500 Resistance sits at 5706 with support established at 5654. Todays slight sell-off did break the 9- day rally, however limited price activity within a narrow range did little to change the overall picture as the uptrend remains intact. While the market waits for new tariff/trade deals to be announced neither buyers nor sellers took charge. Buyers will aim to break above 5700 while sellers look down to the 5600 level.

GOLD As the USD and equity markets tread water, gold had a strong day wiping out small losses from last week on the way to establishing resistance at $3331. Clearly demand for the safe haven commodity remains in place with todays bounce aided by the technical fibonacci retracement tool. Note the preceding uptrend measured from $2952 up to $3500 - the retracement got held up at the 50% level ($3226) which provided a floor and springboard for buyers to reassert the upward bias. While buyers continue to aim higher, sellers will aim to retest the $3220 area.

BRENT OIL Todays limited bounce did not take away from the strong downtrend. Support sits at $5857 - low levels not seen since 2021, while resistance at $60.77 matches Friday’s low. Noteworthy that buyers could not regain Friday’s close price above $61.00. Unsettled tariff/trade deals and potential recession worries resulting from a global economic slowdown both contribute to the sell tone. Add to the equation the lack of supply concerns and sellers will continue to aim below the pivotal $60 mark.

BITCOIN Neither buyers or sellers made a move today as reflected in the doji-like daily candlestick. Price action was contained within an unusually narrow $1K range between $93.6K and $94.6K. Although the EMAs point down, thereby signalling a downtrend on the charts, buyers may well see todays low as a higher low with the bias slightly tilted to the upside as buyers aim above $95K. Sellers look down to retest the $92.6K area.

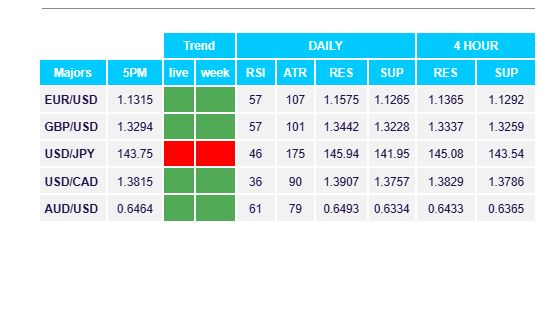

FX Pivot Levels