Market Highlights

1 - S&P closes higher for the 8th consecutive day

2 - Gold down $54 to $3233; US 10yr yields up 3.3bps; WTI crude up $0.80c to $59.02

3 - USD/JPY soars as yields turn higher; USDCAD back above 100/200 MAs

4 - USD continues to run higher alongside stock markets

5 - Fridays non farm payrolls - does it really matter if its pre tariffs?

Daily Price Activity

Insights

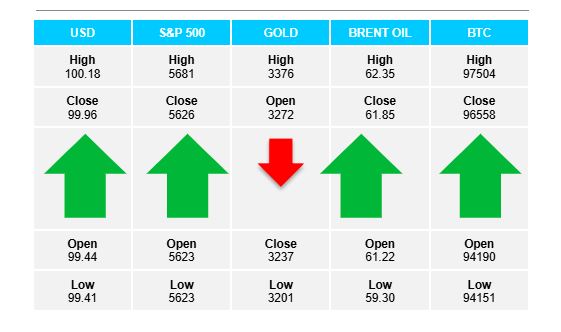

USD INDEX The U$ started the new month on the front foot making it 3 consecutive days of higher highs and higher lows. The uptrend gained momentum and broke above the previous resistance, which now acts as the daily support at 99.38. Buyers broke above the 100 mark and went onto set resistance at 100.15. With RSI at 45 there is plenty upside room should fundamentals add to the technical picture. It seems that although the negative sentiment continues to surround the USD, as long as there is no bad news the demand may continue - no news is good news.

S&P 500 A mixed day saw a gap up to start, buyers adding to the after hours move, only for sellers to end the US session with a late day sell-off and ending the day back where it started. Technically its been 8 consecutive days of higher highs and a positive start to the new month. Resistance sits at 5683 with support matching the days open at 5626. While buyers will be eyeing the 5700 level, sellers will be looking back at the 5600 mark.

GOLD A gap down to open and a 3rd consecutive day of lower lows and lower highs added to the downtrend and a new support established at $3200. Buyers stepped in during the afternoon portion of the session and went on to close at $3237. Continued USD buying and additional profit taking will see sellers eyeing $3000 on the downside. For the most part buyers are remaining on the sidelines waiting for a new floor to be established - perhaps the same pivotal $3000 mark. Any new negative fundamental news on the economic, political and geopolitical fronts will likely see immediate renewed demand for the safe haven commodity.

BRENT OIL Sellers continued where they left off for the past 3 days and went on to make a new low at 59.35 before buyers stepped in, recouped the early losses and went onto close higher at 62.36. Notwithstanding the green candlestick and mini rally, the daily charts confirmed a lower high and lower low - adding to the downtrend. Buyers will aim above $63 to add any technical relevance to a potential rebound, while sellers will be aiming to retest below the $60 mark. Lack of supply concerns, an unsettled tariff environment and signs of an economic downturn continue to contribute to the lack of demand.

BITCOIN A strong day for the cryptocurrency which broke out of its 8 day narrow sideways range with buyers going on to establish resistance at $97.5K…and the $100K mark clearly in sight. Trend, bias and sentiment are all contributing to the demand. Sellers will look below $95K as a first target to reverse the trend.

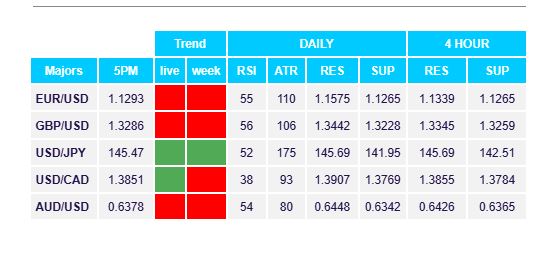

FX Pivot Levels